comments (single view)

He doesn’t pay his fair share on it, but he also doesn’t get any benefit from it until it is sold. If they sell the stock, trade it to buy something, or give it away it is taxed instantly.

Ordinary people don’t have to pay taxes on money sitting in the bank or in stock. If we’re trying to make them pay their “fair share” (which would imply you can be unfair in both undertaxing and overtaxing), they should pay only for money that they actually use.

Billionaires actually spend money from loans, not their stock. The stock sits unused most of the time. So, we should tax the loans they get (currently untaxed), not the stock. That’s the reason stocks and unrealized gains are untaxed: it would be unfair to continuously tax people year after year for money that they don’t even use.

Also, the only thing that adding more taxes would do is drive them to other tax havens and tricks to evade taxes. And, even if all billionaires were taxed at 100%, it could only sustain the federal government’s spending needs for 2.5 months (src: https://www.politifact.com/factchecks/2011/oct/20/paul-ryan/ryan-says-100-percent-tax-millionaires-would-only-/). Perhaps you should focus on other ways to solve economic problems, rather than the unattainable goal of taxing the rich?

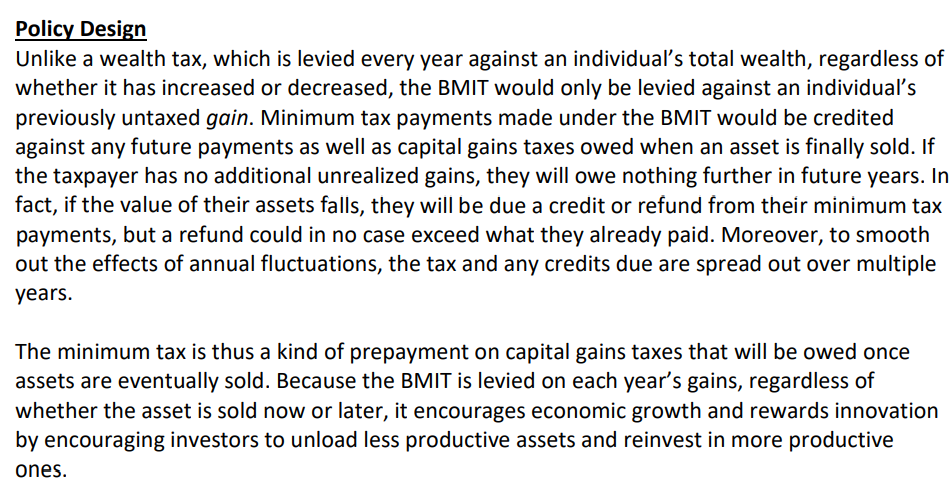

There are other solutions, including offering a refund if they lose their unrealized gains later, which makes this type of policy more fair and largely prevents over-taxation. But because we can agree that undertaxation occurs more often, this will prevent overtaxation while forcing them to pay a fairer share.