comments (single view)

is it really fair for billionaires like donald trump and elon musk to pay $0 on their hundreds of billions of dollars in stocks? seems like a loophole that means that poor people (whose money is not in stocks) pay more than the ultra rich. this is a loophole that is currently being exploited and means that these billionaires do not pay their fair share.

they will pay their fair share when they sell the stock.

Keep in mind, the stock value could just disappear if the stock tanks. If we tax them every single year on money that could just vaporize into thin air, they could end up paying much more than their fair share. They deserve their money just as much as we do, you know (at least most of them do).

And, they don’t actually get any benefit from stock (other than control of the company) until they sell it. The way billionaires really get money (to spend) is that they get loans, with their stock as collateral. Why don’t you tax loans instead?

they should tax that too

but if a billionaire like Jeff Bezos never sells his stock (which he almost never does), he will likely never pay his fair share on it. if i get a traditional job that pays me in cash, that should count as income. The same is true for the ways these billionaires get paid. they use public services, roads, law enforcement, airports for sky travel, air control, fire departments, the mail service, etc. so they should pay every year on their income, whether or not it's realized yet. if their unrealized gains disappear (which can also happen to traditional cash jobs when banks/markets crash or when a recession happens) they should suffer the same way ordinary people do.

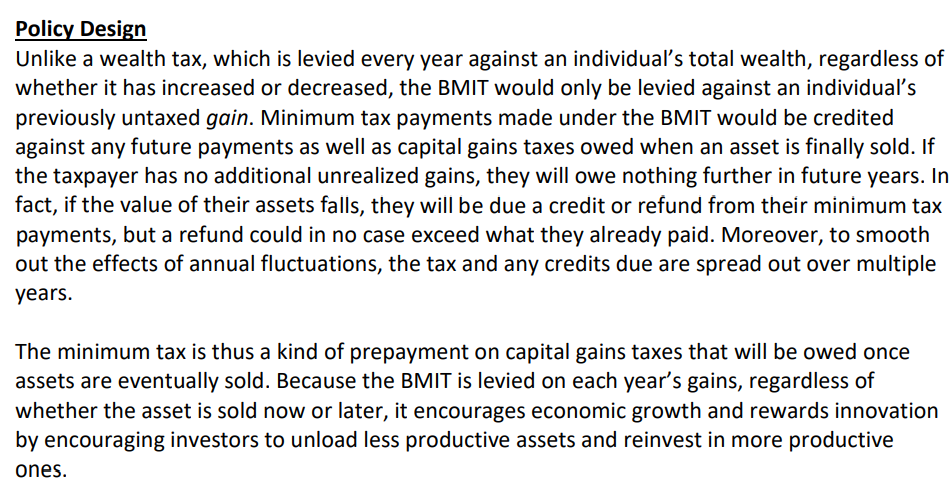

Here is an example bill that does this: https://cohen.house.gov/sites/evo-subsites/cohen-evo.house.gov/files/BMIT%20One%20Pager.pdf

He doesn’t pay his fair share on it, but he also doesn’t get any benefit from it until it is sold. If they sell the stock, trade it to buy something, or give it away it is taxed instantly.

Ordinary people don’t have to pay taxes on money sitting in the bank or in stock. If we’re trying to make them pay their “fair share” (which would imply you can be unfair in both undertaxing and overtaxing), they should pay only for money that they actually use.

Billionaires actually spend money from loans, not their stock. The stock sits unused most of the time. So, we should tax the loans they get (currently untaxed), not the stock. That’s the reason stocks and unrealized gains are untaxed: it would be unfair to continuously tax people year after year for money that they don’t even use.

Also, the only thing that adding more taxes would do is drive them to other tax havens and tricks to evade taxes. And, even if all billionaires were taxed at 100%, it could only sustain the federal government’s spending needs for 2.5 months (src: https://www.politifact.com/factchecks/2011/oct/20/paul-ryan/ryan-says-100-percent-tax-millionaires-would-only-/). Perhaps you should focus on other ways to solve economic problems, rather than the unattainable goal of taxing the rich?

There are other solutions, including offering a refund if they lose their unrealized gains later, which makes this type of policy more fair and largely prevents over-taxation. But because we can agree that undertaxation occurs more often, this will prevent overtaxation while forcing them to pay a fairer share.